Understanding Debt-Service Coverage Ratio

May 19, 2024 By Triston Martin

In financial analysis, the Debt-Service Coverage Ratio (DSCR) is a very important measure. It helps to understand if the borrower can pay back their debts. This ratio shows the connection between the company's net operating income and its debt duties. DSCR gives us an understanding of the company's financial condition and how well it can repay its debts.

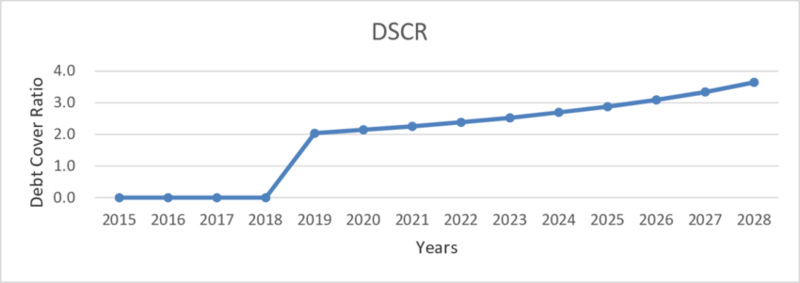

Analyzing DSCR Trends

Studying the change of DSCR over time gives a crucial understanding of how well a company is doing financially and staying stable. If there is a constant upward trend, it means that the financial health of the firm is getting better because there are enough earnings to pay off debts without difficulty. On the other hand, if we see a decreasing trend this may show economic problems, showing difficulties in repaying money for business operations.

Studying the DSCR movement in various economic cycles provides more understanding of a firm's ability to endure and change. For example, if DSCR stayed the same or got better during times of economic decline, it shows strong handling of money matters and risk reduction methods which put the company in a good light when markets are unpredictable.

- Consider cyclical factors: Assess DSCR trends across economic cycles to gauge financial resilience.

- Account for external influences: Analyze the impact of external factors, such as industry trends or regulatory changes, on DSCR fluctuations.

Interpreting DSCR Values

Understanding DSCR values is important for making financially wise choices. A DSCR of 1 or more shows that a company earns enough money to pay its debts. Ratios below 1 mean there isn't enough cash flow for debt payment, which can question the capability of the borrower to repay debts.

Furthermore, we can assess DSCR about industry benchmarks and similar companies. If the DSCR is better than what's typical for the sector, it means that this business has a good financial condition and handles debt well. On the other hand, if it falls below average levels or near them this may call for a more careful examination of the riskiness involved with managing ongoing operations of an enterprise along with its capacity to pay back long-term debts.

- Benchmark against industry standards: Compare DSCR with industry averages to assess relative financial performance.

- Consider peer comparisons: Evaluate DSCR about peer companies to identify competitive positioning and industry trends.

Impact of DSCR on Lending Decisions

DSCR holds a big role in making lending choices, helping lenders to measure if borrowers are trustworthy for credit. Normally, lenders like those with DSCR numbers more than 1 because it decreases the chance of non-payment and guarantees that the loan will be paid back on time. On the other hand, low DSCR numbers may increase interest rates or cause rejection of loan applications due to the higher risk involved in lending money.

Furthermore, lenders might give special conditions like less interest percentage or extended time for repayment to those borrowers who show good DSCR. This shows that they have trust in their capacity to fulfill financial duties. On the other hand, if there is a weaker DSCR it could lead to more necessary investigation or danger premiums which will change the total cost of borrowing.

- Influence on interest rates: Strong DSCR can result in lower interest rates and favorable loan terms.

- Risk assessment implications: Weak DSCR may lead to heightened scrutiny and higher borrowing costs.

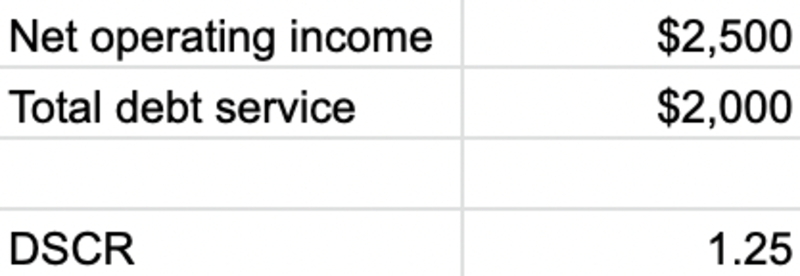

Calculating DSCR

To find the DSCR, we divide the company's net operating income (NOI) by its total debt service. The formula is DSCR= Total Debt Service/Net Operating Income. Net Operating Income consists of earnings before interest, taxes, depreciation, and amortization (EBITDA), and Total Debt Service includes all payments related to debt like interest, principal as well as lease payments.

Moreover, when we look at the historical DSCR values, it gives us an idea about how things were in the past. But to project future DSCR, you need to make precise predictions for both income and expenses. Sensitivity analysis assists with evaluating different situations' effects on DSCR and improves handling risks as well as making decisions.

- Forecasting considerations: Project future DSCR by accurately estimating income and expenses.

- Sensitivity analysis: Conduct sensitivity analysis to evaluate DSCR under different scenarios and assess risk exposure.

Strategies to Improve DSCR

To improve DSCR and enhance financial stability, there are a few strategies that can be used. These include increasing revenue, reducing operating expenses, refinancing debt at lower interest rates, and optimizing the structure of capital. Also, careful management of finance like keeping enough cash reserves can help to increase DSCR and reduce risks in repaying loans.

Make your income more steady by using a revenue model that is not dependent on just one or a few sources. This will help to lessen the impact of market changes and give better resilience to handle downturns in specific sectors. Also, consider putting into action active strategies for managing debts like restructuring debts or working out agreements with lenders for more beneficial conditions which could help in lessening financial stress and enhancing DSCR over some time.

- Diversify revenue streams: Expand revenue sources to mitigate income volatility and enhance financial resilience.

- Proactive debt management: Implement debt restructuring or negotiation strategies to improve DSCR and reduce financial risk.

Conclusion

To sum up, the Debt Service Coverage Ratio (DSCR) is an important measure in detailed financial analysis and making decisions about loans. By carefully looking into DSCR changes, understanding different value meanings, and taking steps to improve ratios, businesses can greatly improve their financial situation. This helps to reduce dangers linked with paying back debt while also creating a good setting for continued growth and steadiness. As a result, businesses can use DSCR as an important measure for handling financial difficulties prudently and making the most of their capital management plans to achieve steady success and strength in changing market situations.