Understanding Mutual Funds

May 18, 2024 By Susan Kelly

Mutual funds are a way of investing that combines money from investors to buy securities like stocks, bonds, or other types of assets. These funds are controlled by professional portfolio managers who decide how to invest the pooled money for all investors involved in this fund. Mutual funds provide two main benefits, spreading risk through diversification and having professionals manage your investments. These features make them appealing choices for people with different levels of risk tolerance and investment aims.

Types of Mutual Funds

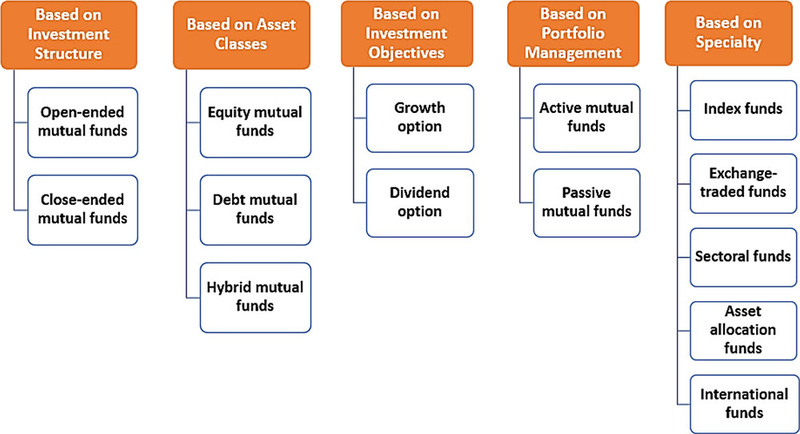

Mutual funds come in many types, each one made for various investment goals and levels of risk. Funds related to equity mainly put money into stocks and this offers the possibility for big profits but also comes with more danger. In contrast, bond-related funds invest in fixed-income securities like government or company bonds. These provide lower returns yet exhibit less volatility. Balanced funds, also called hybrid funds, invest in a combination of stocks and bonds to give a balanced method toward risk and return.

Investors looking for a steady increase in capital over a long time usually like equity funds because they have shown better results than other types of asset classes when observed for extended periods. However, these funds are linked with the stock market and this can cause their value to go up or down greatly. On the other hand, bond funds are appreciated for their stability and ability to generate income. People who avoid risks or those nearing retirement may prefer them because they put importance on protecting capital.

- Tax Considerations: Investors should be aware that bond funds may generate taxable income, which can impact overall returns, especially for investors in higher tax brackets.

- Diversification Benefits: Balanced funds offer investors the benefits of diversification by spreading investments across multiple asset classes, reducing overall portfolio risk.

Specialized Mutual Funds

In addition to the basic equity, bond, and balanced funds, there exist mutual funds that are concentrated in specific sectors or investment themes. Sector-focused funds are designed for a specific industry like technology or healthcare. These let investors take advantage of opportunities within that sector. Index-based funds duplicate the performance of a particular market index, giving access to wide market movements at low cost. Furthermore, thematic funds put money into firms that are related to certain trends or themes like clean energy versus artificial intelligence.

Sector funds might attract investors who wish to focus their investments in particular industries they think will perform better than the overall market. For instance, technology sector funds could incorporate companies engaged in activities like developing software, making hardware, or providing internet services. Thematic funds give access to rising trends and game-changing technologies which can offer chances for high returns on investment.

- Risk Considerations: Specialized funds, such as sector or thematic funds, tend to be more volatile than diversified funds, as they are heavily concentrated in specific industries or themes.

- Research and Due Diligence: Investors should conduct thorough research and due diligence before investing in specialized funds to understand the underlying risks and potential rewards associated with these investments.

Mutual Fund Pricing

Prices of mutual funds are set by the net asset value (NAV) per share. This NAV is found by dividing the overall value of all assets in a fund by the number of shares that have been issued. Normally, NAVs are calculated at the close of business day using closing prices from underlying securities within the fund's portfolio. People who put money into mutual funds can purchase or sell their shares at this NAV price and it could change due to alterations in what these holdings are worth.

Besides NAV pricing, a mutual fund might have various share classes also. Each class could come with its fee structure and method of setting the price. For instance, institutional share classes usually show lower expense ratios than retail ones; this makes them better suited for investors in institutions or individuals with high net worth. Knowing the distinctions in pricing among different share classes can assist investors in selecting the most economical option for their investment requirements.

- Market Timing: Mutual fund transactions are executed at the end-of-day NAV price, regardless of the timing of the investor's buy or sell order. This helps prevent market timing strategies that may disadvantage long-term investors.

- Transparency: Mutual fund prices are transparent and publicly available, allowing investors to track the fund's performance and make informed investment decisions based on current market conditions.

Load vs. No-Load Funds

Another way to classify mutual funds is by their fee structure. Load funds require a sales commission or fee when buying and selling shares, this payment goes to the fund's salesperson or distributor. On the other hand, no-load funds don't have these sales commissions which makes it less costly for investors. But, what is more essential to recognize for investors is that no-load funds might have other charges like management fees and running costs.

Load funds often have various share classes such as front-end loads, where you pay a fee when buying, and back-end loads require payment upon selling your shares. These sales charges can impact the total return on investment, especially for people who frequently buy or sell fund shares. No-load funds might be more attractive to those investors who focus on reducing fees and expenses.

- Share Class Considerations: Load funds may offer different share classes with varying fee structures, such as Class A, Class B, or Class C shares. Investors should carefully evaluate the costs and benefits of each share class before making an investment decision.

- Fee Waivers: Some mutual funds may offer fee waivers or discounts on load fees for certain investors, such as those investing above a certain threshold or participating in employer-sponsored retirement plans.

Expense Ratios and Fees

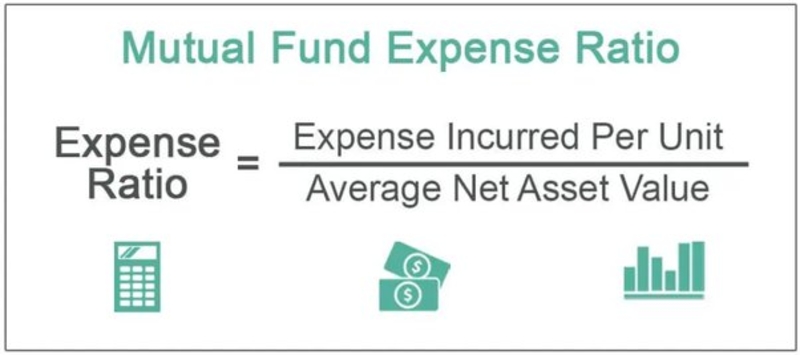

Expense ratios are like yearly charges that mutual funds impose to cover their operational costs. These expenses consist of management fees, administrative expenses, and marketing expenditures. The rate is presented as a fraction of the fund's average assets under its control per year and may differ considerably among various funds. When choosing mutual funds, investors need to consider expense ratios because higher fees can reduce overall investment returns over some time.

Mutual funds have expense ratios, but there could be other fees too. This includes things like redemption fees - a cost that comes when an investor sells their fund shares in certain time frames to stop quick trading and timing the market. Also, account maintenance fees (or account service fees) are charged to cover administrative expenses linked with keeping the accounts of investors.

- Passive vs. Active Management: Actively managed mutual funds typically have higher expense ratios compared to passively managed funds, as they involve active research and investment decision-making by portfolio managers. Investors should consider whether the potential benefits of active management justify the higher fees.

- Fee Negotiation: Some brokerage firms or financial advisors may negotiate fee discounts or rebates on mutual fund expenses for their clients, particularly for large investment accounts or high-frequency traders. Investors should inquire about fee negotiation options to potentially lower their investment costs.

Conclusion

To end, mutual funds give an easy method for investors to get a share in a varied collection of securities handled by expert investment managers. By learning about different kinds of mutual funds and how they are priced, investors can choose wisely based on their investment goals and ability to handle risk. Whether one is putting money into equity, bond, or specialized fund types it remains crucial that they consider charges involved along with performance track records as well as strategy used by the particular fund manager; all these factors contribute towards creating an effective investment portfolio.