A Complete Guide to Net Worth

May 19, 2024 By Triston Martin

Net worth acts as a picture of your money situation, showing the value of what you own after subtracting debts. Essentially, it represents the balance between what you have (assets) and what is owed to others (liabilities). When you check your net worth often, it helps to understand how healthy your money matters are.

Calculating Your Net Worth

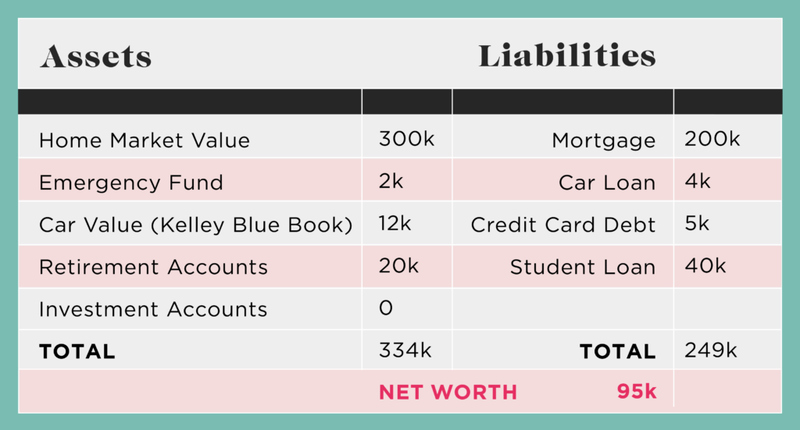

To calculate your net worth, gather details about all your assets and liabilities. Assets can be things like liquid assets (such as savings and checking accounts) or less liquid assets such as real estate and retirement accounts. Do not forget valuable possessions like jewelry or art, these also add to the total value of what you own. When you gather your assets, it's time to deal with liabilities. These are all the debts you have - from things like a mortgage or car loan to the balance on your credit card and student loans. If you subtract all of what is owed (liabilities) from everything that's yours (assets), then this gives us our net worth.

Calculating net worth is a task that demands careful focus on details. Be sure to incorporate each asset and liability, even those which may appear minor. Every small thing can affect your complete monetary summary. Also, from time to time make sure to reevaluate your net worth and include any modifications in assets, debts, or overall financial situation.

- Regular Evaluation: Reassess your net worth periodically to reflect changes in your financial situation, ensuring accuracy in your financial planning.

- Professional Assistance: Consider consulting a financial advisor for guidance on calculating and interpreting your net worth accurately.

Importance of Knowing Your Net Worth

Knowing your net worth is like a compass for managing money, helping you make good decisions and plans. It helps you understand where you are financially now so that you can set realistic goals. If you wish to save for retirement, buy a house, or clear your debt, knowing your net worth helps you choose actions that match these financial goals.

Additionally, the changes in your net worth can show how well you're doing financially as time goes on. If you keep an eye on it regularly, this helps to see trends - good or bad - and change up strategies for managing money. Taking action like this improves your financial stability and ability to handle ups and downs in the economy along with unforeseen costs.

- Goal Setting: Utilize your net worth as a baseline for setting realistic financial goals and tracking your progress toward achieving them.

- Financial Awareness: Understanding your net worth fosters financial awareness, helping you make informed decisions and adapt to changing circumstances with confidence.

Assets - Understanding What Counts

Assets are what you own and they make up your net worth. These holdings can be of many kinds, not only usual monetary assets such as cash or investments but also physical items like property (real estate) or vehicles. Additionally, personal belongings such as jewelry, art pieces, and old objects contribute to your total net worth. Knowing about various types of assets that influence your net worth calculation helps you get a full understanding of your financial condition and chances for development.

In addition, it's necessary to separate liquid and non-liquid assets for better strategic financial planning. Assets like cash and stocks are easy to convert into money quickly. Yet, illiquid assets such as real estate might not be readily transformed into cash, needing more time or work on them. Maintaining a good mix of your assets allows you to have both quick access to funds and growth possibilities over the long term within your financial collection.

- Asset Liquidity: Consider the liquidity of your assets when assessing your net worth, balancing accessibility with long-term growth potential.

- Appraisal Accuracy: Ensure accurate valuation of assets by periodically appraising items like real estate, jewelry, and collectibles to reflect their current market value.

Liabilities - Identifying Your Debts

Liabilities are financial duties that lessen your total value, and they cover many kinds of debts. It includes everything from home loans and car payments to unpaid credit card balances or school loans you still owe money on. Understanding liabilities correctly is very important since it helps in figuring out your real financial position and planning successful methods for managing debt.

Also, when you focus on paying back debts that have high interest rates and short terms, it can speed up how fast you reach financial freedom. This is because tackling the expensive borrowing costs helps to reduce them quickly and boosts progress towards growing your net worth. Furthermore, having a good grasp of what you owe gives you the ability to choose wisely about borrowing and repaying debt.

- Debt Prioritization: Strategically prioritize debt repayment based on interest rates and terms to minimize overall borrowing costs and accelerate financial progress.

- Borrowing Awareness: Maintain awareness of your borrowing habits and liabilities to make informed decisions about future borrowing and debt management strategies.

Factors Influencing Net Worth

Net worth is affected by many things. This shows the complicated mix of your personal money situation and outside elements. The amount of money you make, how much you spend, how well your investments do, and what kind of debt management methods are used, all these factors impact where on a net worth path someone might be at any given time. Big life changes like getting married or divorced, and receiving an inheritance can greatly affect someone's total worth too which then requires them to adjust their financial plans and targets accordingly.

Furthermore, economic situations and changes in the market affect the value of assets and return on investment. This has a direct impact on your total worth. By comprehending these many-sided elements, you can maneuver through the changing field of personal finance with strength and flexibility to keep advancing towards your money goals.

- Economic Environment: Stay informed about economic trends and market conditions, recognizing their impact on asset values and investment performance.

- Life Event Preparedness: Anticipate major life events and their potential effects on your net worth, proactively adjusting your financial plans to accommodate changes.

Conclusion

Net worth serves as a fundamental metric in financial assessment, offering insights into your financial standing and guiding your financial decisions. By calculating and monitoring your net worth regularly, you gain a clearer understanding of your financial health and can take proactive steps toward achieving your financial goals.