Understanding Payday Loans

May 18, 2024 By Susan Kelly

Payday loans are small amount, short-term loans that people usually use to manage costs until their next payday. These types of credit are created for quick access to money when unexpected financial crises or shortages occur. You can get payday loans from physical shopfront lenders or through online platforms, and they typically carry high interest rates and fees associated with them. This article wants to give a complete understanding of payday loans. It will explain how they work, the good and bad points about them, applying for one, and other choices you have.

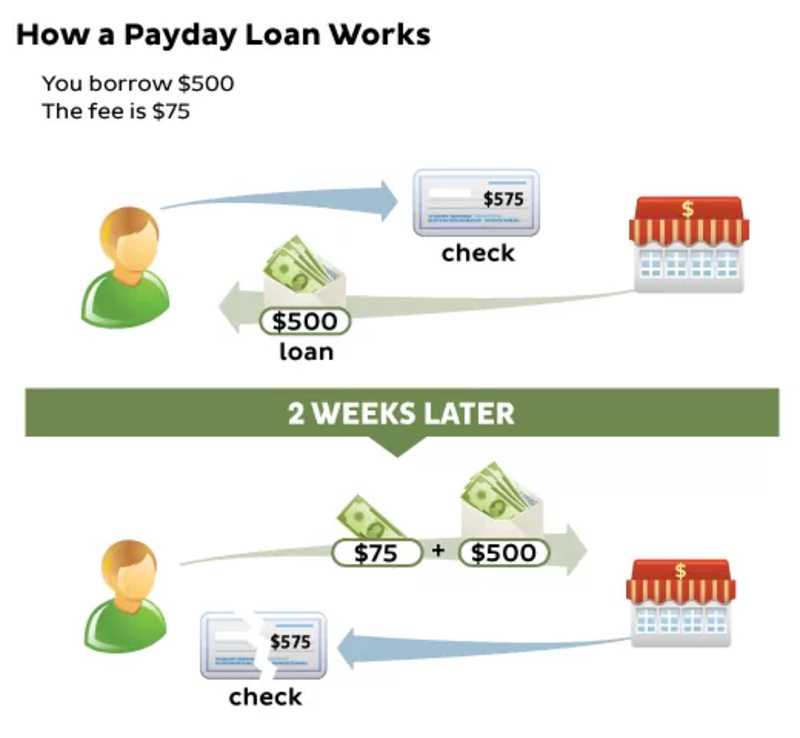

Mechanics of Payday Loans

A payday loan is quite basic in its functioning: the person getting money gives a post-dated check to the lender, who then gives them cash. This check will be collected on their next payday, and the borrower must return the amount taken along with interest fees at that time. The sum you can borrow typically ranges from 30-50% of your monthly income before taxes are deducted. The payment due date for this type of lending usually falls within 2-4 weeks after issuance. If the person who borrowed money from a loan provider cannot pay back the full amount, they might have the option to renew or rollover their loan. This renewal will come with more charges.

More than the simple facts, it is very important to comprehend the legal rules around payday loans because they differ from one state or country to another. These regulations often determine how much can be loaned, the interest rates and fees that lenders are allowed to charge, along with limits on rollovers and renewals. Those who borrow should make sure they know about laws in their area so as not to become victims of bad lending situations.

- Regulatory Oversight: Payday loans are subject to regulations that vary by location, and governing factors such as maximum loan amounts, interest rates, and fees.

- Borrower Rights: Understanding local laws empowers borrowers to advocate for themselves and avoid falling prey to unfair lending practices.

Pros and Cons of Payday Loans

Even though payday loans provide a fast way to get money without checking credit, they have some big problems. On one hand, these types of loans are available for people who have bad credit or no credit history at all. The application process is easy and usually quick. On the other hand, interest rates and fees on payday loans can be very high which makes them costly. This leads many borrowers into a cycle of debt. Also, the short payback time might make it difficult for borrowers to fulfill their monetary commitments unless they borrow again.

In the debate about payday loans, it's crucial to balance between needing instant cash and thinking about long-term financial effects. Even if these loans offer short-term help, they can make an already existing money problem worse for many people who take them out quickly because of their high cost and strict repayment conditions. Payday loans can be a quick solution for immediate monetary needs, but they might worsen your current financial situation over time. People who are considering taking out such a loan should think carefully before making this commitment and explore other options first.

- Long-Term Impact: Payday loans can lead to a cycle of debt, making it difficult for borrowers to achieve long-term financial stability.

- Financial Planning: Borrowers should explore alternative options and consider their long-term financial goals before opting for a payday loan.

Application Process for Payday Loans

For getting a payday loan, some normal requirements are: showing evidence of income in the form of a pay slip or bank statement; proving your identity, and having an active checking account. The way you go through the application procedure might change depending on who lends money to you but generally, it's about filling up a basic form that can be done either online or face-to-face. After sending the application, the lender will examine your details and decide if they want to approve a loan or not. Once approval is given, the borrower gets the money via electronic transfer or cash according to what has been arranged with their lender.

Apart from what's needed in paperwork, those who borrow should understand the possible outcomes if they fail to pay back a payday loan. Defaulting might lead to extra charges, harming their credit rating, and even legal steps by the lender. It is crucial to borrow with care and only get a payday loan if you can repay it completely and punctually.

- Default Consequences: Defaulting on a payday loan can have serious financial and legal repercussions, including additional fees and damage to credit scores.

- Responsible Borrowing: Borrowers should only take out a payday loan if they are confident they can repay it in full and on time to avoid negative consequences.

Alternatives to Payday Loans

Even though payday loans appear convenient when you urgently require money, other solutions might be less expensive and less hazardous. These choices involve borrowing from close ones, discussing with creditors about extending deadlines for paying bills, getting help from nearby charities or government schemes, as well as investigating low-interest loan possibilities offered by credit unions or online lenders. Moreover, individuals who borrow can also commit themselves to enhancing their financial circumstances by making a spending plan, establishing an emergency savings account, and looking for financial advice if necessary.

Along with the usual options, progress in technology has given rise to new financial solutions that can be used by people for better management of their cash movement. These comprise peer-to-peer lending systems, apps for salary advance, and financial wellness plans from employers which provide substitutes for classic payday loans while encouraging good money habits and flexibility.

- Technological Solutions: Innovative financial products and services provide alternatives to traditional payday loans, promoting financial health and resilience.

- Financial Wellness: Exploring non-traditional options can help individuals better manage their finances and avoid the pitfalls of payday loans.

Conclusion

To sum up, while payday loans can be a short-term solution for people dealing with money crises, there are many dangers and disadvantages linked to them. Those who borrow these must understand the conditions and expenses involved before they decide on one. They should also look into other choices if possible. By using their knowledge of finance and asking for help when necessary, people can handle their money better and prevent getting trapped in the debt loop of payday loans.