Your Guide to Insurance for Comprehensive Financial Security

May 18, 2024 By Triston Martin

Insurance, an important part of the financial planning process, is a way to safeguard against unpredictable occurrences. It creates a safety net that protects people and businesses from potential money loss because of the different risks they face. This piece gives an all-inclusive understanding of insurance, and how it works with its many types, for helping you handle this crucial area in managing your finances.

The Concept of Insurance

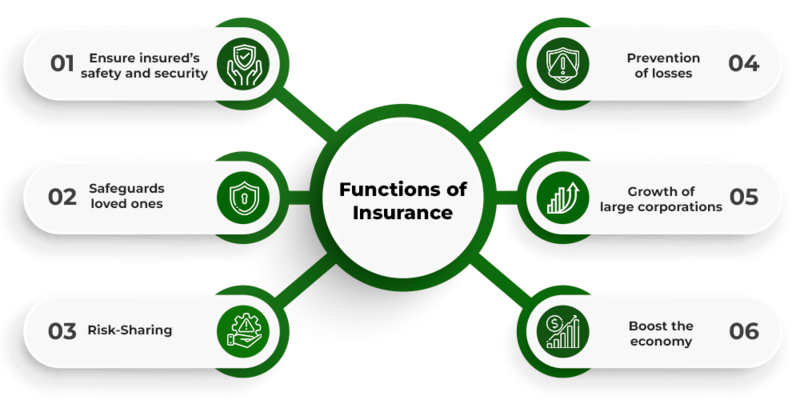

Insurance, essentially, is a method for controlling risk. It helps in moving possible losses from people or organizations to insurance firms. Policyholders pay premiums and get protection against certain risks like accidents, sicknesses, and harm to property. The agreement of insurance sets out the conditions where the insurer will compensate the policyholder if they suffer a loss that falls under their policy's coverage.

Insurance works like a money security blanket, giving protection from unexpected happenings that might cause serious financial trouble. It gives comfort to people and businesses, making them feel safe because they are not fully responsible for paying all the money related to bad events. Insurance also encourages smart planning by helping people understand and handle risk well which boosts overall financial strength.

- Consideration: It's crucial for policyholders to thoroughly review insurance policies to understand coverage limitations and exclusions, ensuring adequate protection against potential risks.

- Caution: Failure to disclose relevant information to insurers accurately may result in claim denials or policy cancellations, underscoring the importance of honesty and transparency in insurance applications.

How Insurance Works?

Insurance works based on the idea of spreading risk. This means that possible losses are shared among many policyholders, lessening the financial load on any one person or organization. The method of collecting money from all insured individuals and using it to pay for claims as they occur is known as pooling premiums. It allows insurers to distribute risk across their customer base, making sure there are enough funds available when needed while also helping in managing overall exposure (policyholders). By dividing risks over numerous people or companies, insurance firms lessen the effect of bad events and guarantee stability in finances for everyone involved.

Besides ensuring financial safety, insurance contributes to a feeling of security and steadiness for those who have policies. This allows them to confidently chase their individual and work-related aspirations. Insurance removes worries about possible money difficulties, giving power to individuals and companies to make lasting investments as well as tactical choices that aid in economic expansion and wealth creation.

- Fact: Insurance premiums are calculated based on various factors, including the insured's risk profile, coverage limits, and deductible amounts, with higher-risk individuals typically paying higher premiums.

- Noteworthy: Policyholders can customize insurance coverage to suit their specific needs by selecting optional riders or endorsements to enhance protection against particular risks.

The Role of Insurance in Risk Management

Insurance plays a pivotal role in mitigating risks and safeguarding financial interests for individuals and businesses alike. By transferring the financial consequences of potential risks to insurance companies, policyholders can minimize the impact of adverse events on their financial well-being. This risk-sharing mechanism not only protects individuals and businesses from significant financial losses but also promotes stability and resilience in the face of uncertainty.

Moreover, insurance contributes to economic stability by facilitating investments and entrepreneurship. With the assurance of financial protection against potential risks, individuals and businesses are more inclined to undertake ventures and investments that drive economic growth. Insurance provides a safety net that encourages innovation and risk-taking, essential elements for fostering a dynamic and robust economy.

- Consideration: Regularly reviewing insurance coverage is essential to ensure alignment with evolving needs and circumstances, allowing policyholders to adjust their protection accordingly.

- Noteworthy: Insurance policies often include provisions for risk mitigation and loss prevention measures, such as discounts for implementing security systems or safety protocols, incentivizing proactive risk management practices.

Types of Insurance Coverage

Insurance covers a wide range of risks. Each one needs particular policies crafted for special needs and situations. For instance, life insurance gives money protection to those who will get it if the person with the policy dies. This brings peace of mind and financial safety to loved ones left behind. Health insurance also falls under this category, covering medical costs made because of sickness or injury. It guarantees access to good healthcare without heavy financial strain from high expenses incurred during treatment procedures, etc.

Property insurance is a way to protect physical assets such as homes, vehicles, and businesses. It offers financial reimbursement for losses caused by covered perils. Auto insurance gives coverage against accidents, theft, and other damages to the vehicle involved - it provides monetary protection as well as legal adherence for drivers. Insurance of liability helps individuals and companies safeguard themselves from legal responsibilities because of negligence or wrongful acts; it covers the costs related to lawsuits along with any compensatory damages awarded by court decisions.

- Fact: Business insurance may include specialized coverage options such as business interruption insurance, which compensates for lost income and operating expenses during periods of business disruption.

- Caution: It's essential for policyholders to accurately assess their insurance needs and seek guidance from insurance professionals to avoid underinsurance or overinsurance, which can lead to inadequate protection or unnecessary expenses.

Conclusion

Insurance is a very important method to handle risks and keep financial interests safe. By knowing about insurance, how it works, and the different kinds of insurance there are, people or companies can make wise choices on how best they should safeguard their money matters for complete financial safety. No matter if you need to protect yourself from unexpected events or make plans for upcoming times, insurance plays an essential part in ensuring stability and calm in an uncertain world.