All About Stock Options Trading

May 18, 2024 By Susan Kelly

Trading stock options give investors a different method for making money in the stock market. When you buy an option's contract, it means that you have acquired the privilege to purchase or sell shares at a prearranged price within a particular period. This article serves as a complete manual for how to skillfully handle the intricacies involved with trading stock options.

Understanding Options Contracts

Options contracts are tools in finance that give the person holding it, not an obligation but a right to purchase or sell an underlying asset at a fixed price called the strike price, before this date for ending known as an expiration date. The holder of a call option has the right to buy, while the holder of a put option can sell. Understanding how options contracts work is crucial for devising effective trading plans.

Options contracts are agreements that are the same in structure and can be traded on exchanges. Each contract usually stands for 100 shares of the main asset. These offer traders adaptability and leveraging ability, letting them gain from price changes in the basic asset without having to possess it physically. Moreover, options contracts carry an expiry date; past this date they become valueless. This highlights how timing is very important when dealing with options trade.

- Leverage: Options contracts provide leverage, amplifying potential returns but also increasing the risk of losses compared to trading the underlying asset directly.

- Expiration Dates: It's important to consider the expiration date when trading options, as the value of options contracts, declines as they approach expiration, known as time decay.

Trading Strategies for Stock Options

Different methods for trading options exist to make use of varying market situations and increase profit while decreasing risk. These strategies involve buying call or put options, selling covered calls, using spreads like straddles or strangles, and turning to options as a way to hedge against current positions. Every strategy has its unique level of risk and return, so it must be thoughtfully pondered upon with analysis before execution.

One strategy that is often used by investors involves the selling of covered calls. In this situation, those who already possess the stock in question sell call options against it. This strategy creates income from the premiums earned through selling these options and provides security on the downside until reaching the strike price for these options. Another strategy called a straddle means purchasing both call and put options having identical strike prices along with expiration dates; this allows traders to gain from considerable price shifts irrespective of which way they go in terms of movement direction.

- Implied Volatility: Consider the implied volatility of options when selecting trading strategies, as high volatility can inflate options prices, while low volatility may limit potential profits.

- Assignment Risk: Be aware of the possibility of early assignment when selling options, particularly near expiration dates, which can result in unexpected position closures.

Risk Management in Options Trading

Risk management is very important in options trading, to protect capital and lower possible losses. Actions like creating stop-loss orders, spreading positions around, and using money carefully can help traders handle the natural ups and downs of the options market. Also, learning about the Greeks, delta, gamma, theta, and vega, and managing them could give an understanding of how sensitive prices for different options are to changes in other things. This can help make better decisions.

Using stop-loss orders is very important for managing risk because it can control losses by closing positions automatically when they reach certain price levels that have been set in advance. If you spread out your options across various underlying assets, industries, and expiry dates, this may also help to decrease the total risk of your portfolio as any loss from one position could be balanced out by profits from other positions.

- Position Sizing: Properly size positions based on risk tolerance and portfolio size to avoid overexposure to any single trade.

- Volatility Considerations: Factor in the impact of volatility changes on options prices when assessing risk, as higher volatility increases options prices and vice versa.

Technical Analysis for Options Trading

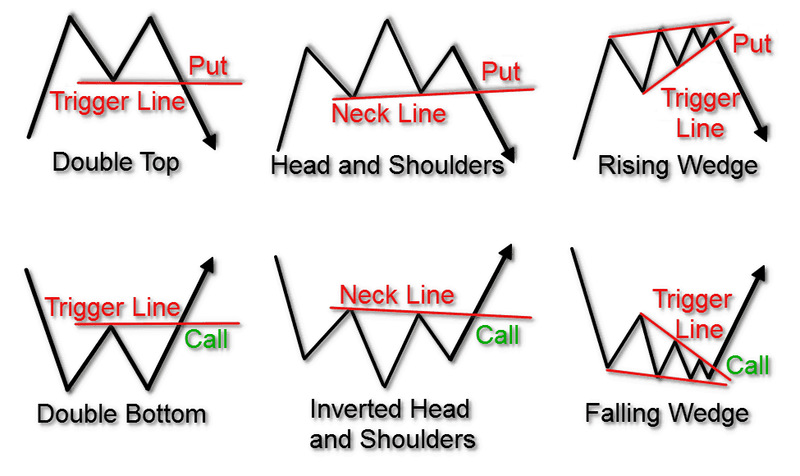

Technical analysis is important for finding good times to begin or end options trades. Using aids like support and resistance levels, chart shapes, and technical indicators such as moving averages or Relative Strength Index (RSI) aids in making clever choices grounded on price movements and market tendencies. Options trading often improves when technical analysis joins with basic examination.

Levels of support and resistance can be seen as important technical indicators that help identify price points where a stock has encountered difficulties in surpassing (resistance) or dropping below (support). Patterns on charts, like triangles, flags, and head and shoulders patterns give clues about possible future price moves according to past price actions. Another thing that technical indicators do is help traders find out if something is too much bought or sold like with the RSI. This could show a turning point in the market.

- Confirmation Signals: Look for confirmation signals from multiple technical indicators before making trading decisions to increase the reliability of signals.

- Timeframes: Adjust the timeframe of technical analysis based on trading objectives, with shorter timeframes suitable for day trading and longer timeframes for swing trading or investing.

Implementing Trading Plans

To have steady success in options trading, it is important to make and stick with a clear trading plan. This plan sets out the criteria for entering and leaving trades, how to manage risks, and rules for executing trades. It assists traders in maintaining discipline by avoiding decisions driven by emotions. This promotes a systematic method of trading that depends on reasoning and analysis rather than impulsive actions.

Apart from the "open and close" rules, a trade plan should also have standards for "position sizing." This means setting a maximum percent of capital to risk on each transaction. Additionally, traders need to make rules about how often they will check and change their trading plans. This allows them to stay flexible in response to different market situations while also improving results over time. Furthermore, keeping detailed records of trades can help recognize patterns and areas needing improvement in one's trading habits.

- Review and Adjust: Regularly review and adjust trading plans based on performance and changing market conditions to optimize trading strategies.

- Continuous Learning: Commit to continuous learning and education to stay updated on market trends, trading techniques, and risk management strategies.

Conclusion

For people who have the patience and dedication to study and become skilled in options trading, this can be a profitable activity. By knowing how options contracts work, using good trading tactics, managing risks carefully, and following clear plans for trading, all these factors together can improve your likelihood for success while you navigate through every change in the options market towards meeting your financial ambitions.