Navigating Financial Structures - An Overview

May 18, 2024 By Triston Martin

The debt-to-equity ratio is a key financial measure that compares the amount of debt a company has with its equity. It reveals how much financing comes from debt versus equity. This equation is formed by dividing the sum of all debts by total equity. This ratio tells investors and analysts how much a company relies on borrowed money to fund its operations. It also shows the firm's capacity to pay back debts using its cash flow from regular activities.

Deciphering Financial Leverage

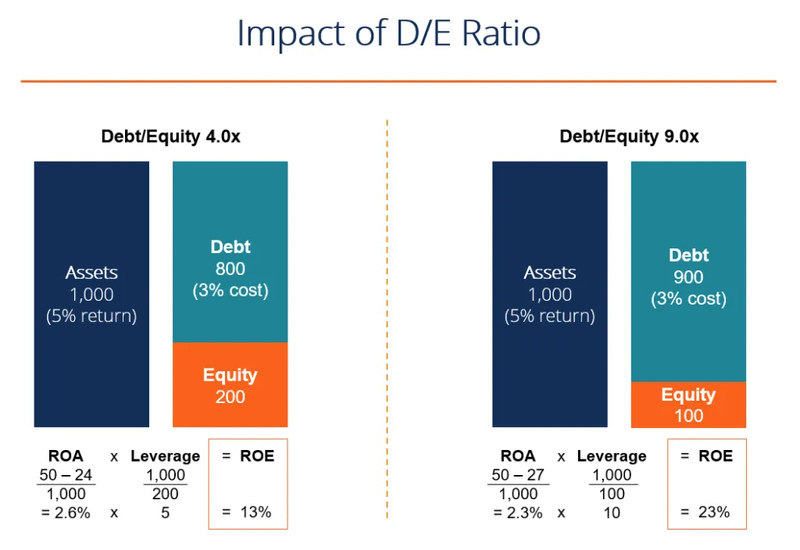

Financial leverage, which is closely connected to the debt-to-equity ratio, shows how much a company uses debt to fund its activities. If the ratio is high it means there's more financial risk because of increasing dependence on borrowed money. On the other hand, if this number goes low it could indicate lower risk but might also signify limited chances for growth in business activities. Understanding financial leverage aids in evaluating a company's risk profile and potential for returns.

In addition, financial leverage can make both profits and losses bigger. It might boost returns on good investments but also increase losses in not-so-good situations. So, investors need to manage the balance between risk and reward that comes with varying amounts of leverage.

- Consider cyclical industries: Companies in cyclical industries may experience fluctuations in earnings and cash flows, impacting their ability to service debt effectively.

- Evaluate interest rate risk: High debt levels expose companies to interest rate fluctuations, affecting their cost of borrowing and profitability.

Analyzing Capital Structure Dynamics

Capital structure deals with the composition of a firm's financing sources, such as debt and equity. It affects the general financial health and risk level of a company. Companies try to achieve equilibrium in their capital structure to enhance financial results and reduce danger. The study of capital structure dynamics means understanding the balance between debts and equities, looking at elements like interest percentages, marketplace situations, and business standards.

Additionally, the perfect capital structure can be different for each industry and business phase. Sectors that have steady money coming in and low risk of finance may be able to manage greater amounts of debt when compared to those that are more unstable or risky. It's very important to comprehend these subtleties while creating suitable strategies for capital structure.

- Consider industry benchmarks: Different industries have distinct optimal capital structures based on factors such as cash flow stability and asset tangibility.

- Assess regulatory constraints: Regulatory requirements may impose limitations on debt levels, especially in highly regulated industries like banking and utilities.

Interpreting the Debt-to-Equity Ratio in Context

Making sense of the debt-to-equity ratio is not straightforward. You must think about different things, like industry standards, business size, and its stage of growth. When the ratio is much higher or lower than what's normal in that industry it could show a strong or weak money situation for the company respectively. Also, looking at how this ratio compares to other similar businesses can give you an understanding of your relative performance and competitive position. Investors should evaluate the ratio together with other financial indicators to make a complete assessment of a company's money flow.

Additionally, the shift in debt-to-equity ratio throughout time indicates the progress of financial tactics and company circumstances. Examining patterns in this proportion aids interested parties in evaluating management's choices regarding capital distribution and foreseeing forthcoming financial results.

- Evaluate debt maturity profile: The maturity profile of debt obligations influences a company's repayment obligations and liquidity position.

- Assess off-balance-sheet liabilities: Off-balance-sheet liabilities, such as operating leases and contingent liabilities, can impact a company's risk profile and financial leverage.

Evaluating Risk and Return Implications

The ratio of debt to equity affects the risk and return characteristics of a company. If a firm has high leverage, its financial danger could increase but it might also improve returns by using possible leverage effects on investments. Nevertheless, too much debt can cause financial problems and block growth opportunities for the company. On the other hand, if we use a cautious method where leverage is low, it can lower danger but might also restrict chances for growth and profit. In this way, assessing the risk and return effects of the debt-to-equity proportion is crucial to deciding about investments.

Additionally, tax advantages are present in debt financing as interest payments can be deducted. This further increases cash flows and profitability. Nonetheless, investors need to consider the benefits of debt along with its possible risks and make certain that levels of debt are maintainable.

- Consider credit ratings: Credit ratings reflect a company's creditworthiness and affect borrowing costs and access to capital markets.

- Assess liquidity position: Maintaining adequate liquidity is essential for meeting short-term obligations and capitalizing on strategic opportunities.

Implementing Strategies for Optimal Financial Management

Keeping the right debt-to-equity ratio comes from good financial management. Companies might change their capital structure by refinancing debt, giving out equity, or reorganizing existing responsibilities. This careful planning also looks at things like managing cash flow, the ability to pay back debts, and goals for growth in the future. Through skillful control of the debt-to-equity ratio, companies can reduce risk, increase financial adaptability, and generate worth for interested parties.

Also, companies must pay attention to being clear and open with stakeholders about their choices related to capital structure. Transparent disclosure along with good investor relations helps build faith and trust, leading to improved chances for the company to access capital markets and support its strategic plans.

- Monitor debt covenants: Compliance with debt covenants is essential to avoid default and maintain access to financing options.

- Diversify funding sources: Relying on diverse funding sources reduces dependency on any single financing channel and enhances resilience to market fluctuations.

Conclusion

To sum up, comprehension of the debt-to-equity ratio, financial leverage, and capital structure is critical for evaluating a firm's monetary status and making knowledgeable investment choices. By examining these measurements in connection with others and contemplating risk and return effects, investors can proficiently manage their path through financial markets. Also, companies can maintain a good equilibrium between debt and equity by using plans that are best for taking care of finances. This helps in keeping them strong over time while growing steadily.