Understanding Mortgages

May 19, 2024 By Susan Kelly

Mortgages are basic financial instruments that allow people to buy property without having all the money needed for the purchase at once. A mortgage is a kind of loan usually taken from a bank or lender, which involves borrowing a large amount of money to purchase a home or real estate. This article will go over various kinds of mortgages and how they work, along with examples for better understanding.

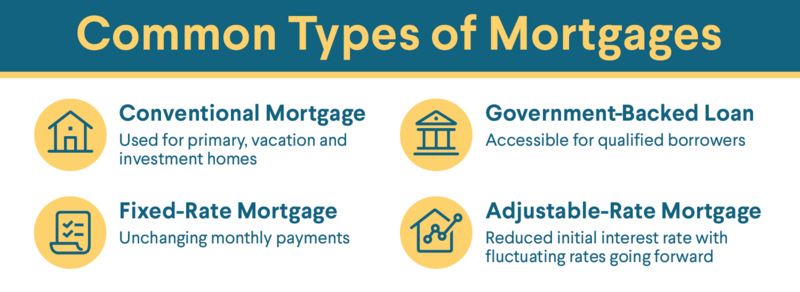

Types of Mortgages

Different types of mortgages are suitable for different financial situations and needs. Mortgages with a fixed interest rate provide stability because the rate stays the same throughout, while those that have adjustable rates (ARMs) change based on market conditions. Also, there exist government-supported mortgages like FHA loans, VA loans, or USDA Loans which give specific choices for certain groups. Mortgages that only require interest are for a specific time, usually followed by higher payments. Jumbo mortgages finance luxury properties and are larger than standard loan limits. Each kind of mortgage has its use, giving the person taking the loan flexibility or stability according to their choice and financial condition.

Fixed-rate mortgages are liked by people who desire stability in their monthly payments. These types of loans ensure that the interest rate stays the same for the whole duration, allowing borrowers to plan their budgets without concerns about changes in the housing market or interest rates. Such steadiness brings a sense of calmness, especially for people purchasing homes for the first time or those with steady incomes.

- Consideration: Consider the long-term financial implications before opting for a fixed-rate mortgage. While the stability of fixed payments offers security, borrowers may end up paying more in interest over the loan term compared to adjustable-rate mortgages if interest rates decrease significantly.

- Caution: Ensure thorough financial planning to accommodate potential fluctuations in property taxes and insurance premiums, which may affect the total monthly payment despite the fixed interest rate.

How do Mortgages Work?

Knowing how mortgages work is important to make good choices. When you get a mortgage, you promise to pay back the loan amount plus interest over an agreed period that can be from 15 up to 30 years normally. Regular payments are made each month and include money towards your loan's main part (known as principal) as well as interest; often there are extra amounts incorporated for property tax and insurance in the monthly payment too. The person giving the loan keeps the title of the property until it's paid back completely. This means if there is a problem with paying off this loan, they can take back your house. Mortgage details such as what period you have to pay in, interest percentage rate, initial payment, and final expenses for closing greatly affect how much it will cost overall and if buying a home can be afforded or not.

Besides the main parts of a mortgage, people who borrow money should comprehend what is called amortization. Schedules for amortization show how every payment on a mortgage gets divided between the original amount and added interest. At first, more of your payment will be used to cover interest costs and then this balance shifts towards reducing principal as time passes in line with loan maturity. This decreasing principal balance results in the property's equity growing slowly, which improves the borrower's financial status.

- Consideration: Consider making extra payments towards the principal balance of the mortgage to accelerate equity buildup and potentially save on interest costs over the loan term.

- Caution: Beware of prepayment penalties that some lenders impose for paying off the mortgage early. Before making additional payments, review the terms of the loan agreement to avoid unexpected fees or restrictions.

Example of Fixed-Rate Mortgage

For her first house, Sarah gets a 30-year fixed-rate mortgage. She borrows $250,000 at an interest rate of 4%. The monthly payment for this loan is around $1,193 including property taxes and insurance costs. Over the entire duration of the loan, that is thirty years, Sarah's monthly payments stay unchanged which offers her stability in managing her finances and making plans ahead.

Fixed-rate mortgages provide borrowers with a sense of stability and confidence because the interest rate stays the same throughout the loan period. This consistent nature lets people plan their money matters properly, knowing that what they pay each month won't change due to market ups and downs.

- Consideration: Consider refinancing options if interest rates decrease significantly after securing a fixed-rate mortgage, potentially lowering monthly payments and overall interest costs.

- Caution: Be aware of potential limitations on early repayment or refinancing imposed by some lenders, which may incur penalties or fees. Always review the terms and conditions of the mortgage agreement before making financial decisions.

Example of Adjustable-Rate Mortgage (ARM)

John selects 5/1 ARM to pay for his fresh condominium. For the starting five-year time, John will have a small beginning interest rate of three point five percent. But once this period ends in five years, the rate changes every year depending on market situations. If the interest rates go up, John's monthly payments might also increase. This could affect his budget and how stable he is financially.

Mortgages with adjustable rates, at the start, have less interest than fixed-rate mortgages which makes these kinds of loans very appealing. This is particularly true for people who want to buy homes but are not able to afford high monthly payments right now or expect their income will increase in the future. Yet, they carry a risk because as time passes and market rates change so can your interest rate on this type of loanso if it goes up greatly then you could end up paying more every month than what was initially planned out in your budget.

- Consideration: Consider the maximum interest rate cap and periodic adjustment limits of an ARM to assess potential worst-case scenarios and ensure affordability over the long term.

- Caution: Be cautious of "payment shock" when the interest rate adjusts, as monthly payments may increase substantially, impacting budgeting and financial stability. Always budget for potential payment increases when considering an ARM.

Conclusion

Understanding the different types of mortgages, how they work, and seeing examples from real life is very important for people when they are dealing with this complex area of real estate finance. Mortgages have a significant impact on helping people become homeowners by spreading out the cost of a property over an extended period. Selecting the correct mortgage, be it one offering stability via fixed rates or flexibility with an ARM, aligns with their financial aims and situation. By understanding the basics explained in this article, people can start their path toward owning a home with assurance and comprehension.